Apartments For Rent

Apartments For Rent

Why is it better to to find apartments for rent than to buy a house?

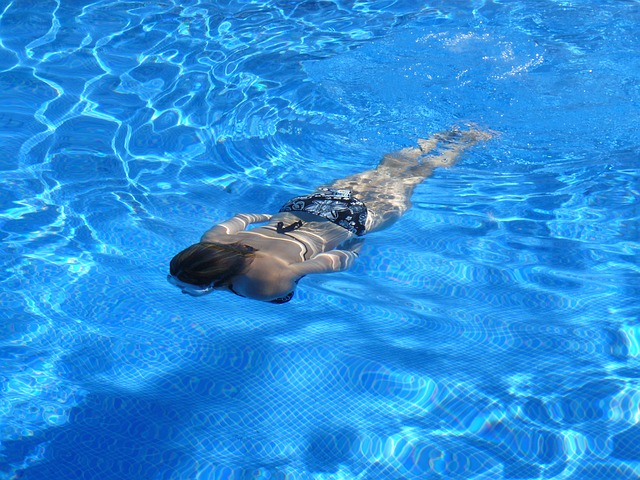

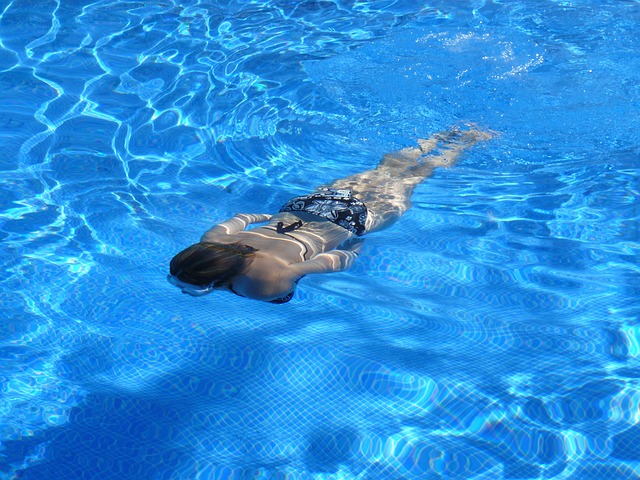

Access to Amenities

Another financial benefit to renting, over buying a house of your own is having access to the apartment community amenities that would otherwise be an enormous expense. Luxuries such as a pool or a fitness center come standard at upscale apartments for rent with no additional charge to residents. If a homeowner wants to match these amenities, he or she can expect to pay thousands of dollars in installation and maintenance costs. Similarly, condo-owners need to pay monthly fees to pay for access to these amenities.

Less Responsibility

When you lease an apartment for rent, most of the responsibility is on the owner’s shoulders. This means that if a pipe bursts and damages the sheet rock inside the home, you’re not likely to have to pay to replace it. However, if you own a house and the same thing happens, the repair bills will come right out of your pocket.

Lower Insurance Costs

While homeowners need to maintain a homeowner’s insurance policy, people who find an apartment for rent would be wise to invest in a renter’s insurance policy. Luckily for renters, renter’s insurance is much cheaper, and it covers quite a lot. The average cost of renter’s insurance is just $12 per month, according to the Independent Insurance Agents and Brokers of America. Meanwhile, the average homeowner’s insurance policy cost ranges between $25 to $80 per month.

Lower Utility Costs

With homes getting larger and larger, it is often much more affordable to heat and power an apartment or small rental home as opposed to a larger home. Apartments for rent typically have a more compact floor plan, and renters can expect lower utility costs.

No Debt

When you find an apartment for rent, you are responsible for the monthly rent and utilities; that s it. On the other hand, when you purchase a home, you re more than likely going to take out a loan to finance it. This will put you in debt a few hundred thousand dollars and possibly delay future plans. Purchasing other things on credit can be pretty difficult, at least until you ve made many payments on the house and have made them on time.

More Freedom

With a apartment for rent, you’ll likely sign a six-month or one-year lease. This means that you re tied to that place for at least that amount of time. Once the time is up, you can move to another location if you choose, or you can renew your lease, provided the landlord agrees. However, when you purchase a home, you are tied to that house for the term of your loan, which is often 20 to 30 years. That is, of course, unless you have the money to purchase a home outright, which most people don t. You may also sell the home, but you are subject to the whims of the housing market.

No Financing

Most individuals who purchase a home need to obtain some type of financing, which usually comes in the form of a loan. There is a long, drawn-out process involved in getting a loan and this sometimes includes exorbitant interest rates. When you rent a apartment, you don’t have to worry about financing.

Short-Term Housing Needs

Renting is best for short-term housing needs, such as those who are attending college or individuals who are in or plan on going in the military. Finding an apartment for rent allows you to move easily when you plan on relocating. However, if you purchase a home, you will have to go through the process of selling it or at least maintaining it, which can be frustrating.